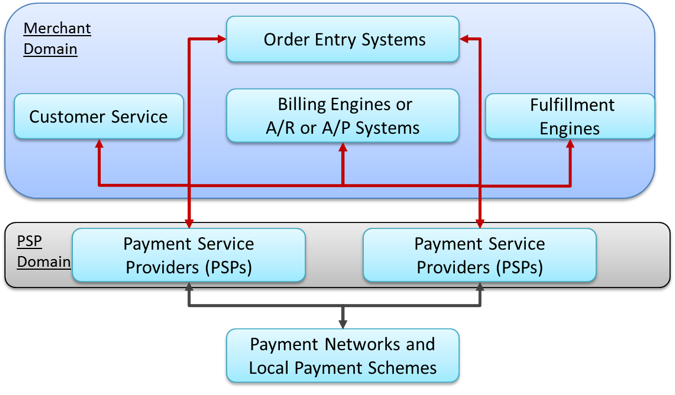

RPGC is releasing a white paper which presents the business case for a new “Payments Orchestration Layer” or POL. Over our many engagements, we have observed that companies have a pressing need for an abstracted layer in which global connectivity, smart routing, real-time ledgers, and end-user tools all work together. Otherwise, environments can look messy, like this:

A Messy Merchant Environment Requiring Multiple Maintenance Efforts

By implementing a POL, businesses can effectively use payments meet their business goals (support market growth, enhance customer experience, and lower costs) without overburdening their already-stretched-thin engineering teams.

The Card Not Present ecosystem has outlived the usefulness of legacy payments architecture. Current gateways and switches (the groups we think are most likely to develop into POLs) fall short in two ways: either they are limited in their connections or they have no flexible end-user tools. Many providers will claim that they can offer the performance of a POL, but that simply isn’t possible given the lack of real-time data inputs and system fragmentation. The POL solves this problem by abstracting all of these systems into its common layer and, with canonical normalizing, data from one system can now augment the performance of a different one. This idea can be applied to familiar ground, like routing rules and retry logic, or it can help merchants expand into new areas, like loyalty as currency or payouts. Without any comparable commercial products available, almost every merchant would benefit from building or buying (once it becomes commercially available) a POL and realize the financial and retention benefits of frictionless payments.

We’ve proselytized the concept of payments orchestration for a while now in Digital Transactions, The Paypers 2019 Payment Method Report, the Merchant Risk Council, and at PaymentsEd Forum. But now, we’re glad to release our treatise on the business case of a POL, free of charge. While we advocate technology for enterprise merchants it’s just as applicable for financial institutions and payment service providers. To see what’s available in the market today, we developed a Payment Vendor Report on the players likely to become Payments Orchestration Layers in collaboration with Paladin Group and under the Merchant Risk Council’s sponsorship.