What, Why, and How

According to FIS, “traditionally, payment analytics awareness has been low and the more savvy merchants have relied on simple reports organized around Bank Identification Numbers (BIN files).” As payment environments complexify, these legacy payment analytics are insufficient to support growth.

For the purposes of simplicity, we will be referring to Bank Identification Numbers (Visa’s proprietary name) and Interbank Card Association (Mastercard’s proprietary name) numbers as BINs.

To understand the ways in which BIN-based analytics are currently failing us, we need a solid understanding of what BINs are, why they are meaningful to us for processing payments, and how you can access BINs as a merchant. Once we have established the usefulness of BINs, we will explore more suitable ways for merchants to leverage them to maximize revenue, mitigate fraud, and manage expenses.

What’s a BIN?

For those of you new to payments, the BIN (Bank Identification Number) is the first 6 digits of a credit card–in 2022, BINs will expand to the first 8 digits of the payment card. As the name implies, BINs are used to identify your customer’s issuing bank and where that bank is. (To meet the bare requirements for protecting customer data and meeting Payment Card Information (PCI) data security standards, merchants should only have access to see the BIN and the last 4 digits of the card number.)

Figure 1: The BIN of this card is the first 6 digits (123456). In 2022, the BIN of this card will be the first 8 digits (12345678).

Figure 1: The BIN of this card is the first 6 digits (123456). In 2022, the BIN of this card will be the first 8 digits (12345678).

Naturally, BINs play an important role in the routing of transactions. The more diverse your payments ecosystem is, the more BINs (including ones you may not know yet) come into play. Merchants are given a tool by their Acquirers to sort through these BINs (it is called a BIN File or Table) but as complexity increases, the more likely you are to experience blind spots using these BIN files. No BIN file is truly complete on its own.

Surprisingly, not a lot of merchants procure their own BIN files. Maybe the version you received from your Acquirer was free and it’s easier to work from a single consolidated source, so why would you go and buy another one?

There are many reasons a merchant might want better BIN visibility: geographic coverage, specific tools (ex. Health services account card, prepaid general purpose payment cards), or to better control fraud, cost, and customer experience. While no BIN file is truly complete, you can still dramatically improve your routing visibility by using BIN tables to track card product attributes.

BIN Tables

BINs are provisioned to issuers by the card networks. Because of this role, networks are the ultimate arbiter of who gets assigned what BINs, who can access the BIN tables, and what they can do with them. Mastercard allows developers to access their BINs through the Mastercard BIN Table Resource. Visa distributes BINs to Issuers and Acquirers: the “members” of their network. This information is not made available to those who are not “members” (namely merchants).

Merchants are expected to access this information through their Acquirers and other providers. Acquirers add value to the merchant by consolidating BINs with their card product attributes across all the networks of which they are members. This means that an acquirer that is only a member of Visa and Mastercard may not be able to provide details into JCB transactions within their file. Unfortunately, we find many merchants are still unable to get visibility on all the BINs in their ecosystem.

As a merchant, without a banking license, you are reliant on your Acquirer to give you your BIN file. For example, Visa assigns a number to the Issuer and Acquirer for all its cards, sets these numbers in a list, and circulates it to its “members,” namely those same Issuers and Acquirers (they are the only two parties other than Visa who actually receive this list). There is no pathway for a merchant to become a “member” of the Visa network without a banking charter. Each network has its own workflows, organization structure, and policies around their BIN tables, but in general merchants are kept partitioned from BIN data.

What Can I do with a BIN Table?

This list is by no means exhaustive. It is organized to speak to different motivations.

Enhance the customer experience and maximize sales.

- Identify issuers that are over-declining your transactions so that you can isolate and triage such events.

- Identify income segments among customers by identifying BIN account ranges within different BINs. This data can be shared with marketing to segregate customer income segments.

- Identify BINs that can only be used in-country (e.g. local Brazil cards that Brazilian issuers will only accept if processed from a local Brazilian entity) to quantify best processing path to accepting a customer’s payment.

- Inline validation: reduce customer error on the checkout page (e.g. if the customer selects Visa from a drop-down menu, but types in a Mastercard BIN).

Fraud Control

- Identify non-reloadable prepaid or gift cards so that they can be rejected and the customer can be asked to use a different card for subscription payments.

- Prevent acceptance of cards where the cardholder’s issuer does not match the device fingerprint.

- Check to see if the card issuer is in a country you are allowed to do business in.

- Ask for a PIN when supported as with local European card brands.

- Identify issuers that are causing you a spike in chargebacks.

Cost Control

- Calculate interchange costs and identify downgrades (using the BIN Account Ranges of each transaction to feed your data warehouse to calculate your pre-qualified interchange rates and reconcile against your acquirer invoices).

- Identify debit cards that can be routed for lower cost through EFT networks.

- Identify cards that cause cross-border assessments (0.8% – 1.2%) before sending the authorization message to the acquirer so that they can first be routed to another subsidiary with a legal entity in an area that eliminates these fees.

- Identify commercial cards that qualify for Level II and Level III data (when these cards are submitted with the requisite data, interchange costs on these transactions decrease).

- Prevent API calls to pre-auth services or authorization calls for cards that can’t be used to transact on your platform (e.g. health care cards, fleet cards, cards for debt paying services).

What solutions do merchants have?

BIN lookup

One resource available to merchants is BIN lookup, in which merchants manually put up a call against someone else’s BIN file. It can be useful when looking at potential fraud, but generally this is a very manual process that isn’t automated, which makes it poor for scaling. But, there’s plenty of free BIN lookup services offered by both Acquirers and Third Parties. Merchants need to justify the ROI for graduating from BIN lookup to implementing and refreshing a BIN file. We think USD $50 million in transaction volume is a good threshold to justify costs. For those doing less, BIN lookup is perfectly adequate for merchants with reasonable chargeback ratios.

Asking your Acquirer

Each Acquirer has their own policies around BIN files: some charge merchants for it, some won’t provide it in any capacity, and others grant free access to it, provided the merchant can code for the Secure File Transfer Process. The Acquirer already had to make a BIN file for their own internal use, so each one is proprietary to them and formatted uniquely. Most BIN tables include some of the same basic data elements, such as card product attributes. Other BIN files set themselves apart with performance-based metrics that offer added value but these are more commonly found in Third Party BIN files than in the Acquirer ones.

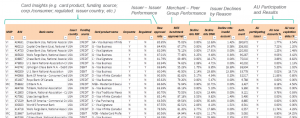

Figure 2: The Worldpay BIN file includes card product insights as well as performance-based data such as Issuer performance and declines by reason

As the world’s largest acquirer, Worldpay’s Issuer Insights provides some insightful benchmarking data. Data fields for issuer performance and declines by reason code are rare to find in any BIN file. But there also needs to be other solutions for merchants that can’t afford the Issuer Insights or aren’t Worldpay clients.

Buying from a Third Party

The level of depth in your BIN table data varies by source, and usually the most extensive BIN files are Third Party ones. Third Party BIN files are usually consolidated and normalized resources (each one having their own data normalization of course). Combining many BIN files into your backend may require seeking outside help. We have a long history of helping clients build out a process which incorporates many BIN files into their routing and fraud management systems.

Who are these Third Parties and what makes their BIN files better than your Acquirer’s? For starters, reliance on any single BIN file can result in inaccurate, even misleading, conclusions, according to the Worldpay Editorial Team. In particular, many BIN files lack card product attribute insights.

Worldpay’s Editorial Team provides us with the example “if approvals are low for a particular BIN, there might be a single prepaid card under that BIN that is driving all the declines with insufficient funds.” Worldpay is correct to call out these concerns and that’s why capturing the card product data is critical, regardless of the source of a merchant’s BIN file. Most Acquirer BIN files exclusively track performance at the BIN level. This can result in skew-based errors which compound over time (from averaging card products). Merchants who rely solely on any one BIN file (especially if it can only track at the BIN level) lack the granularity to inform better decisions.

For merchants that are unable to get a BIN file from their acquirers, there are Third Party alternatives in the market. We’ve taken the liberty of consolidating BinBase, BinDB, Fraud Assets and ExactBINs into a comparison table (Figure 3).

| Data Type | Binbase | Bindb | Fraud Assets | Exactbins |

| Visa & Mastercard | X | X | X | X |

| American Express | X | X | X | X |

| Diners | X | X | ||

| Maestro | X | X | X | |

| Discover | X | X | X | X |

| Union Pay | X | X | ||

| JCB | X | X | X | |

| Local cards (international) | X | X | X | |

| Identify Visa Card levels (e.g. Electron, Vpay, Premier, etc.) | X | X | ||

| Identify Mastercard levels (e.g. Maestro, Black, Gold, etc.) | X | X | X | |

| Identify Amex levels (e.g. Blue, Corporate, Centurion, etc.) | X | X | ||

| Issuer Name | X | X | X | X |

| Card Brand | X | X | X | X |

| Issuer Address | X | |||

| Issuer Country | X | X | X | X |

| Funding source (e.g. Credit v Debit) | X | X | X | X |

| Debit Regulated vs non Regulated (i.e. Durbin) | X | |||

| Commercial or Personal | X | X | ||

| Card Level (e.g. classic, gold, platinum) | X | X | X | X |

| Country code ISO 3166-1 (numeric) | X | X | X | |

| Country code ISO 3166-1 (Alpha 2) | X | X | X | X |

| Country code ISO 3166-1 (Alpha 3) | X | X | X | |

| Phone number for credit card service | X | X | ||

| Issuer website | X | X | ||

| Number of records (in thousands) | 366 | 380 | N/A | 339 |

| Identify HSA/FSA/HRA cards | X | |||

| Identify EBT cards | X | |||

| Identify pre-paid cards | X | X | X | X |

| Identify gift cards | X | X | X | |

| Identify Virtual cards | X | X | ||

| Identify fuel cards | X | |||

| Identify Private Label Cards | X | |||

| Support for 8 digit BINs | X | |||

| API access for premium product | X | |||

| Binbase | BinDB | Fraud Assets | Exactbins | |

| Price | $2,999 | $9,800 | $3,000 | $1,900 |

| Free Updates | 2 years | 2 years | 2 years | 2 years |

| Yearly update cost | $499 | $2,400 | $300 | $200 |

| Update Cadence | Monthly | Monthly | Quarterly | Monthly |

| Product | Extended License | Ultimate License | Plan B | Site License |

Figure 3: Four of the major BIN file Third Party players are compared in this table.

Conclusions

- As a merchant with over USD $50 million in volume, you should be using a BIN table to enhance the customer experience and manage both fraud and costs.

- Merchants may need multiple different BIN tables to achieve visibility. That may require development work to automate data normalization and prioritization.

- Merchants should track performance at the Account Range level, not just the BIN level, and may need a Third Party BIN file to do this.

If you’ve got a BIN file(s) and now need to figure out what to do next to maximize this purchase, contact us at info@rpgc.com for a consultation.