Payment Switch: The Base of a Payments Architecture

Whether built or bought, the payment switch is a crucial architecture component for any enterprise merchant.

Rene Pelegero & Daniel Pelegero | @dangerpele |

Merchants have a greater need for a vendor agnostic strategy than ever before. Yet, the implementation and maintenance challenges have also increased. Business objectives of global growth require mitigation against payment providers’ outages, increased sales by lifting authorization approval rates and increased market penetration by offering local payment methods in key markets. Safely achieving that growth demands flexible connectivity to the world’s payment networks. The payment switch is a tool that empowers merchants to build redundancies, extend their networks, and effectively route transactions.

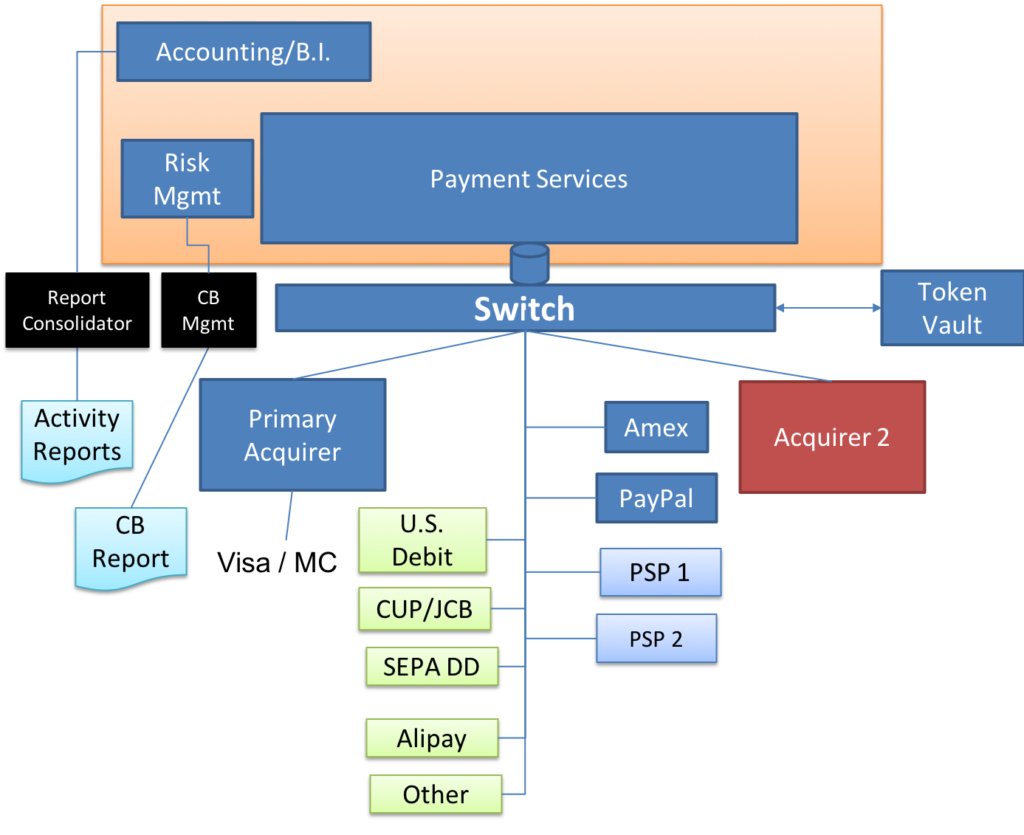

Payment switches are transaction-based software systems that can be built internally or bought off-the-shelf. Using merchant-driven rules, switches dynamically route payment transactions between multiple acquirers and Payment Service Providers (PSPs) end-points. Rules include: retry of declined transactions, routing by lower cost, routing by time of day, routing by BIN, and routing by amount. This ability to dynamically route transactions makes payment switches different from traditional gateways.

While gateways also connect merchants with multiple end-points, their connections are normally pre-defined and not easily altered (i.e. “static”). Moving transactions from one acquirer to another is generally a manual process that must be performed by the gateway operator. This significant difference in routing connections dictates the use of different terminology between two very similar technologies.

Since a payment switch can dynamically route transactions, merchants can easily respond to an acquirer slow-down or outage by routing transactions to their backup acquirer. In the case of a decline from one acquirer, a merchant can immediately retry the transaction through the second acquirer and obtain approval. Some merchants report a 25% to 30% “save” rates on these declined retries. Thus, dynamic routing is a tool merchants use to maintain consistent response times and avoid the possibility of time-outs; all while recovering lost sales.

Merchant reliance on PSP functionality for services such as tokenization and reporting is a common obstacle to adopting a vendor-agnostic strategy. Many PSPs built their token vaults with little thought to what other products, services, or needs their merchants might have (this is getting better though!). By leveraging the switch’s token vault, or using an independent token vault, a merchant no longer needs to rely on any one PSP and can maintain PCI compliance without affecting daily operations. The multiple and disparate reports PSPs provide can also be remedied by a good payment switch; it translates several different data formats and normalizes the data into consolidated dashboards or for export to an analytics tool. In fact several “off-the-shelf” switches offer strong reconciliation engines that allow their merchants to quickly examine payments across the entire enterprise.

***

When considering whether to build or buy a switch, merchants must define their requirements beforehand and understand the tradeoffs. Merchants with strong IT capabilities, payments product management and few long standing PSP relationships may be better off building a switch. Otherwise, merchants who need to constantly connect to multiple new end-points might consider buying.

When evaluating “off-the-shelf” payment switches, consider that some are Cloud-based (“Software as a Service”) and others are software run on-premises. While some switches have extensive connectivity, others may have stronger tools, services, or a more available roadmap to their merchants.

When evaluating a switch, merchants selling 24×7 on a global basis with multiple end-point connections, must consider the following requirements:

- Supports multiple message formats and connections to multiple PSPs and global acquirers

- Uses merchant-driven dynamic routing rules

- Can throttle transaction volumes dynamically between vendors, based on merchant-defined automated parameters

- Has accounting and logging features to support reconciliation across multiple end-points

- Offers encryption and tokenization tools to ensure PCI/DSS compliance

- Consolidates PSP reports and dashboards to simplify payments reporting

***

The major appeal of a switch is driven by the fact that, despite all of their technological redundancies, merchants are still vulnerable to acquirer failures. Given the rising number of processing outages among major acquirers, merchants need to reckon with how much a single payments failure impacts sales and Customer Lifetime Value. Merchants can prevent lost sales by having multiple acquirers supporting their key markets. Built or bought, such a strategy requires a payments switch.